The Ultimate Guide to HVAC Accounting & Bookkeeping (2026)

Why General Bookkeeping Fails HVAC Owners

Scaling an HVAC business from a single "Man-in-a-Van" operation to a 15-truck enterprise requires more than just a growing customer list; it demands a total transformation of your financial architecture. In the high-stakes mechanical trades, success in 2026 is no longer defined by raw revenue but by financial intelligence.

Modern HVAC scaling relies on a shift from retrospective cash tracking to proactive accrual accounting and automated FSM-to-QuickBooks synchronization. To protect the 15%–25% net profit margins typical of top-tier fleets, owners must master fully burdened labor rates, departmentalized WIP tracking, recurring revenue, and ensure all of their software is synced and reconciled correctly.

The Critical Shift: Moving Beyond Generalist Bookkeeping

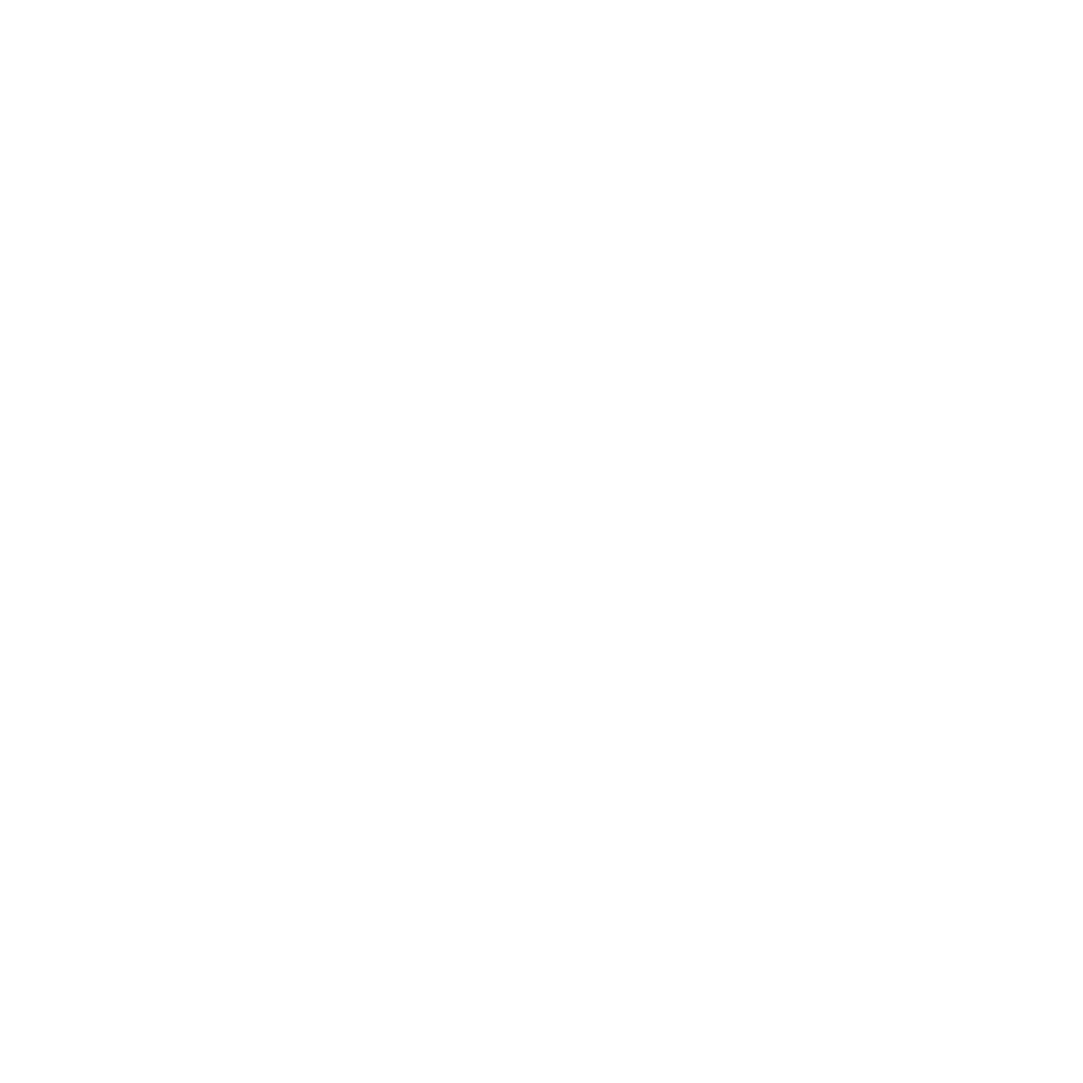

The most common reason HVAC companies plateau at the $1M revenue mark is the "Busy but Broke" paradox. You may have a full schedule and three weeks of backlog, yet find your bank account stagnant or shrinking. This occurs because generalist bookkeeping often ignores the granular operational realities unique to the mechanical trades.

Why Generalist Accounting Fails the HVAC Owner

While a generalist can balance a checkbook, they often lack the industry-specific lens required to spot these four profit killers:

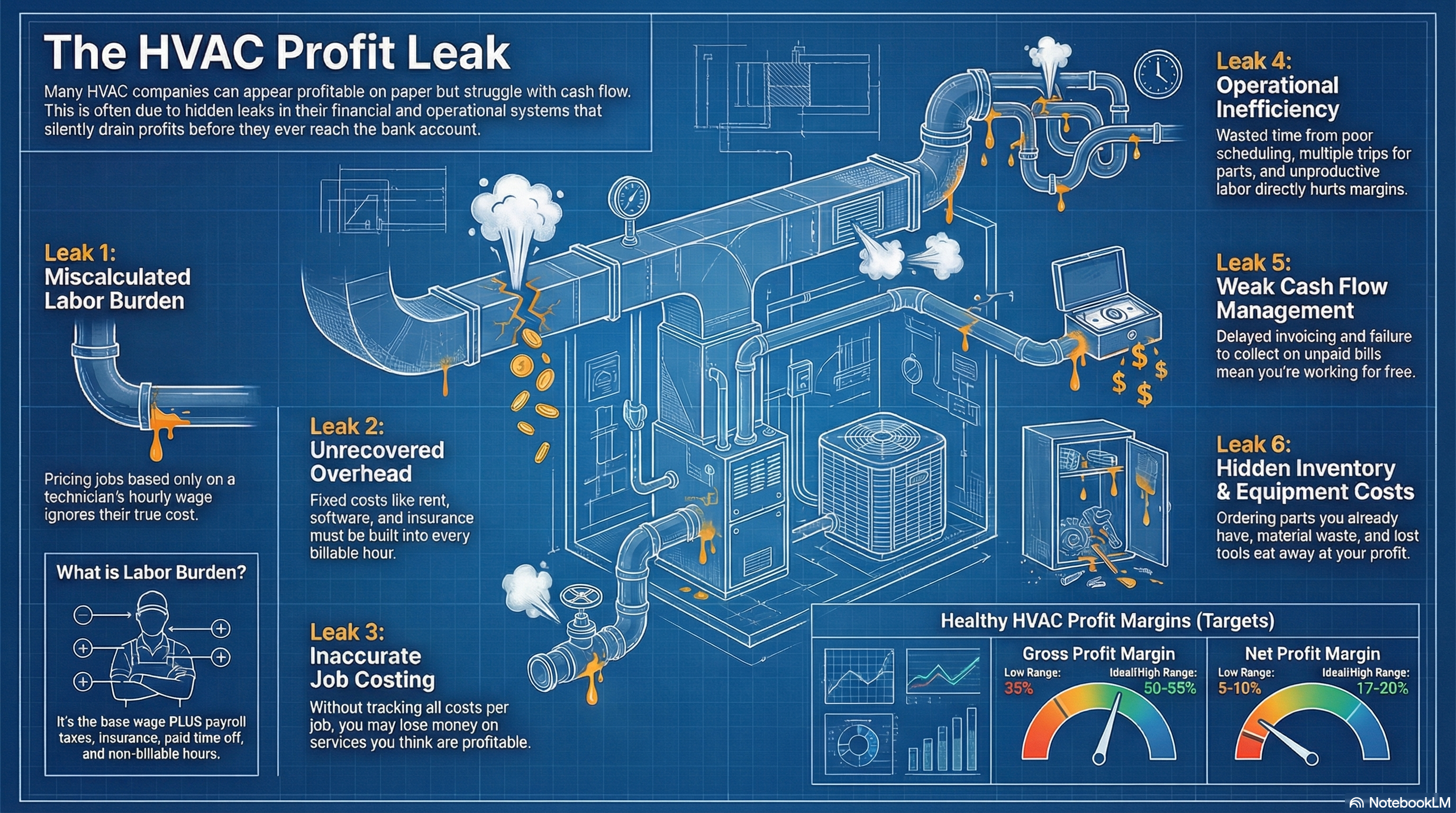

The Labor Burden vs. Hourly Rate Trap:

Generalists often view payroll as a simple expense. A trade specialist identifies your fully burdened labor rate. If you pay a tech $30/hr, your true cost is often $50/hr+ once you factor in payroll taxes, high-premium workers' comp, insurance, rent, software, and vehicle overhead. If you aren't accounting for this burden allocation, your seemingly "profitable" jobs are actually draining your cash reserves.

The "Unapplied Labor" Leak:

A generalist sees hours paid; a specialist sees billable efficiency. Every hour spent on poor scheduling, multiple supply house runs, or "hunting for parts" you already have in the van is unapplied labor. This unproductive time is the primary reason margins erode before the truck even reaches the job site.

Departmental Blind Spots:

Generalists typically use a "one-bucket" approach. They show you your total profit, but they can't tell you if your Residential Install department is losing money while being "carried" by your Service department. Without departmentalized or job-level reporting, you are essentially flying blind.

Weak Cash Flow Management:

In HVAC, cash is the lifeblood of growth. Generalists often fall behind on revenue recognition. Delayed invoicing, failure to collect on unpaid receivables, and failing to leverage vendor terms means your cash is often going out the door faster than it is coming in, strangling your ability to scale.

Implementing the "Matching Principle"

For an enterprise-level fleet, your accounting must move from simple record-keeping to a multi-zone smart thermostat for your business. While a small operation can survive on cash-basis tracking (recording income only when checks clear), a scaling fleet requires accrual accounting.

This allows you to utilize the matching principle: recording your equipment costs and labor in the exact same month the revenue is recognized. This prevents the "financial amnesia" that occurs when a P&L statement looks profitable in July simply because you haven't paid the equipment vendors for those June installs yet.

The 2026 Tech Stack: Establishing a Single Source of Truth

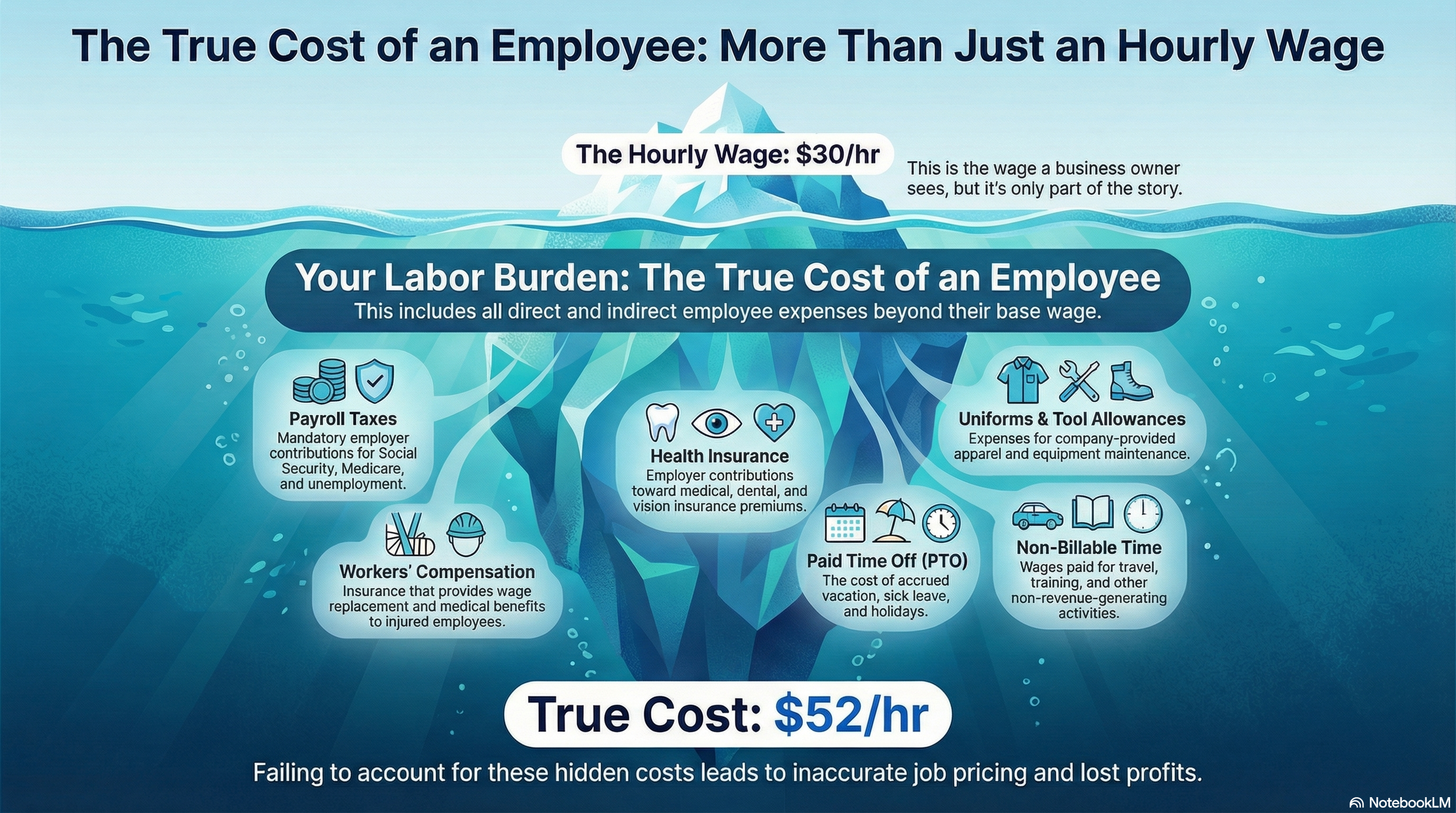

In 2026, manual data entry is more than just an inefficiency; it is a significant liability that invites human error, duplicate entries, and unnecessary audit risk. To achieve true field service profitability, your technology must function as a seamless ecosystem where Field Service Management (FSM) tools and your accounting software act as a unified machine.

The Hub-and-Spoke Financial Model

Think of QuickBooks Online (QBO) as the central hub of your financial wheel. It is your permanent record and the source of your tax filings. Your FSM tools, whether you use ServiceTitan, Jobber, or Housecall Pro, are the "spokes." They handle the high-velocity data of the field: dispatching, equipment serial numbers, and real-time technician timesheets.

Avoiding "Sync Drift" and Mapping Disconnects

The most frequent technical failure we see in HVAC bookkeeping is Sync Drift. This occurs when the bridge between your field operations and your ledger begins to fail due to a mapping disconnect.

If your FSM "Business Units" or "Departments" are not perfectly aligned with your QuickBooks "Classes," your departmental reports will become distorted. Sync Drift creates a dangerous illusion: you might believe your Residential Install team is thriving, when in reality, they are being subsidized by the high margins of a failing Service department. Without precise mapping, your P&L is essentially a work of fiction.

The Golden Rule: The Direction of Data

To maintain data integrity and a reliable audit trail, you must adhere to one non-negotiable rule: Every transaction must originate in the FSM.

From the initial digital invoice created on a tablet to the final payment collected at the kitchen table, the data must flow downstream from the field to the office. Entering an invoice directly into QuickBooks bypasses your operational reporting, breaks your job costing, and destroys your ability to track equipment history.

The Price Book: The Bridge Between Field and Finance

Your Price Book is the most critical piece of real estate in your tech stack. It isn't just a list of parts and labor; it is the translation layer between your technicians' work and your financial reports.

Granular Mapping: Each task in your price book must be mapped to the correct Income and COGS accounts.

Inventory Accuracy: In 2026, if you're tracking real-time inventory, it must be setup correctly. When a tech pulls a motor from a van, your FSM should automatically trigger the corresponding expense in QBO, preventing "phantom profit" from sitting on your warehouse shelves.

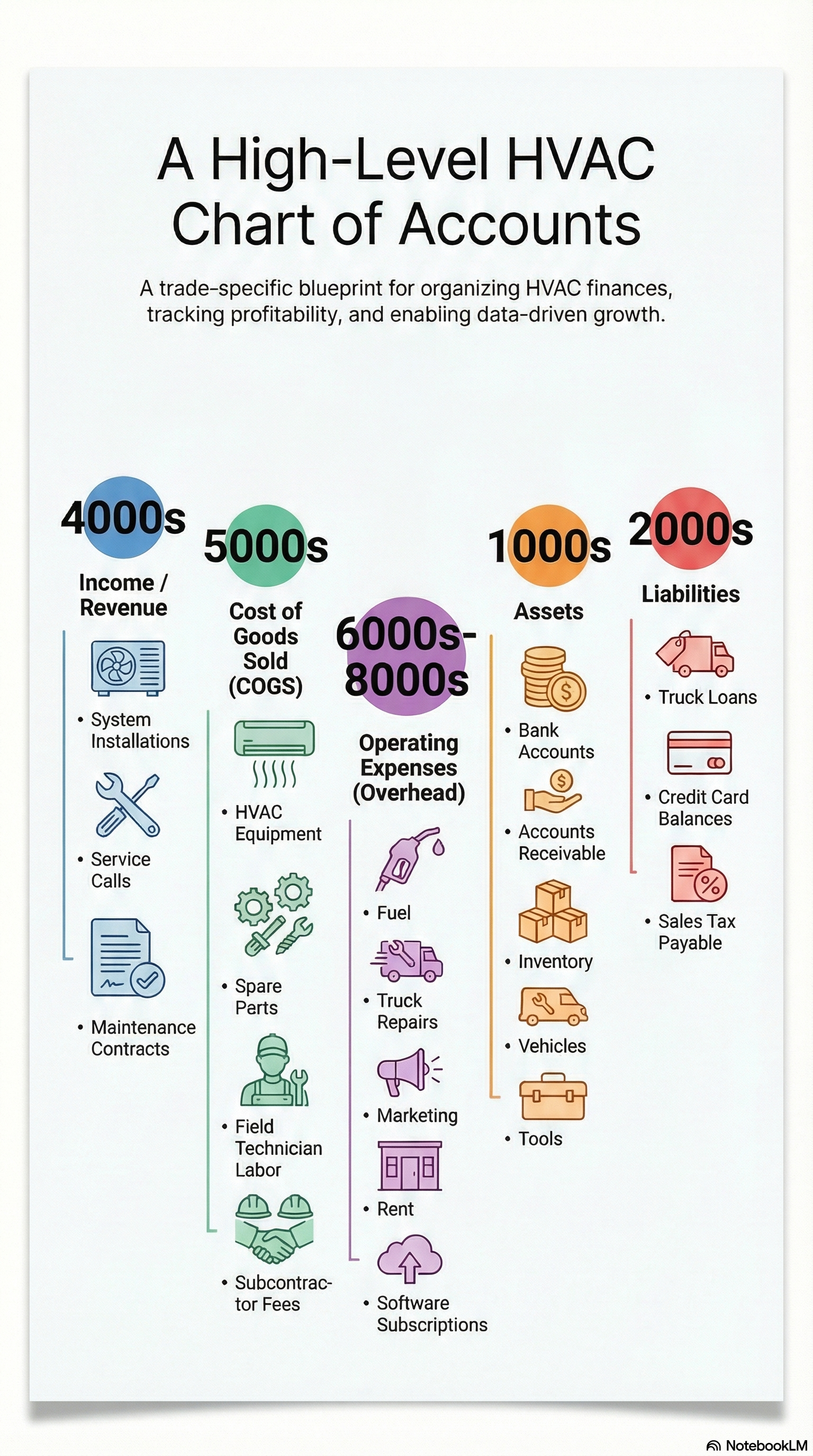

The Framework: Chart of Accounts (COA) & Classes

A generic Chart of Accounts is the enemy of a 15-truck fleet. To act as a CEO, you require a trade-specific COA that categorizes transactions correctly while using Classes to provide departmental visibility.

The "Skeleton": Industry-Standard Numbering

A well-organized COA uses consistent numbering conventions to make financial reports transparent and easy to filter.

1000s: Assets

Bank Accounts, Buildings, Vehicles, Equipment

2000s: Liabilities

Loans, Credit Cards, Payroll Taxes

3000s: Equity

4000s: Revenue

High-level income categories.

5000s: Cost of Goods Sold (COGS)

Direct job costs like materials, direct labor, permits, and subcontractors.

6000s: Operating Expenses

Overhead items like office wages, advertising, vehicles, rent, fuel, and software.

The "Sensors": Using Classes for Departmental Reporting

Do not overcomplicate your COA by creating separate accounts for every department. Instead, use the "Classes" feature in QuickBooks Online to tag transactions by business unit.

Visibility: By using one "Income" account but tagging entries with a "Residential Service" or "System Install" class, you can run a Profit & Loss by Class report.

Insight: This allows you to identify that a high-revenue installation department might actually have lower net margins than your service department.

Looking for a template? Download our Free HVAC-Specific Chart of Accounts here.

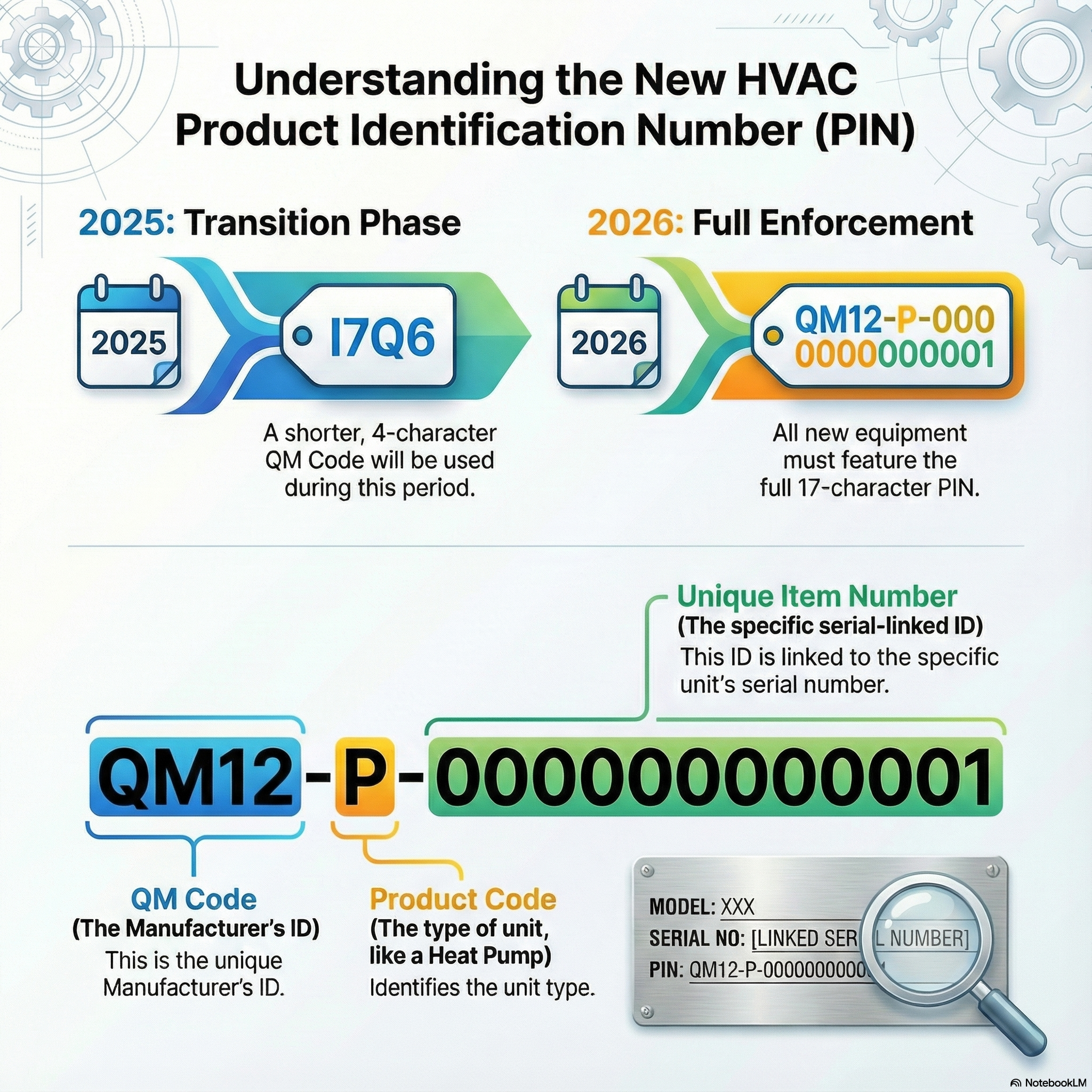

2026 Regulatory Alert: The 17-Character PIN Requirement

In 2026, the IRS has moved from a "transition phase" to strict enforcement for the Energy Efficient Home Improvement Credit (Section 25C). Your field service tool is no longer just for tracking callbacks; it is the front line of audit protection for your customers. If a PIN is missing or incorrect, the IRS can use its "mathematical error authority" to automatically disallow the credit on Form 5695, leaving you with a very unhappy customer.

The 2025 vs. 2026 Transition

While the requirement technically began in 2025, the IRS allowed a 4-character QM Code in lieu of a full PIN during the rollout. As of January 1, 2026, this exception has expired. For all specified property (heat pumps, central AC, furnaces) placed in service this year, the full 17-character PIN is the only acceptable identifier.

The "Audit-Proof" Documentation Checklist

To protect your reputation and your clients' tax savings, your digital work orders and job-costing files must act as a permanent archive. Every high-efficiency install should have the following three data points digitally "stapled" to the invoice:

The 17-Character PIN: Assigned by a Qualified Manufacturer (QM) and unique to that specific outdoor unit or furnace.

AHRI Numbers: The reference number from the Air-Conditioning, Heating, and Refrigeration Institute that proves the system's efficiency rating.

Manufacturer Certification Statement: A digital copy of the certificate confirming the equipment meets the IRS criteria for the tax year.

Analogy: The Financial Pressure Test

For an HVAC contractor, documentation is like a pressure test on a new line set. If you haven't sealed every connection (documented every 17-character PIN) correctly from the start, the system will hold up during the "install" (filing the return), but it will catastrophically fail when the high pressure of an IRS audit is applied.

Pro-Tip: Don't wait for the customer to ask for their PIN next April. Use your FSM to make the PIN a "Required Field" for technicians before they can close out a high-efficiency install job.

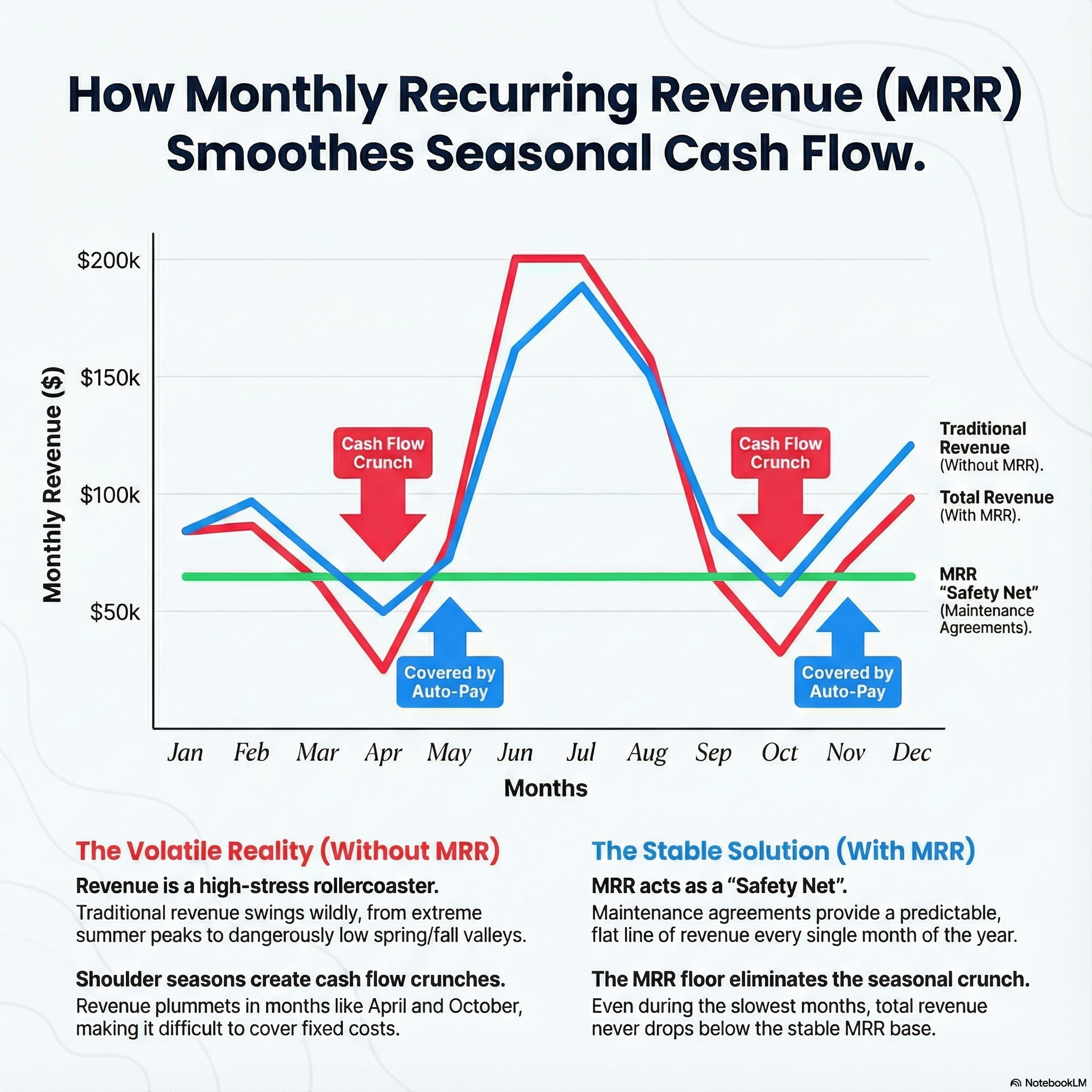

Managing the "Shoulder Season" with Recurring Revenue

Seasonal cash flow swings are the "silent killer" of the HVAC industry. It is common for the business experience a 60-70% drop in revenue during the mild months of Spring and Fall. Without a strategic financial model, these quiet months can force you into high-interest lines of credit just to cover payroll and lease payments.

The Steady Strategy

Successful businesses treat maintenance agreements (service contracts) as the backbone of their business. In 2026, top-performing contractors aim for these agreements to generate 25%–40% of their total annual revenue.

Predictable Cash: Monthly recurring billing ensures that even when the phones aren't ringing for emergency repairs, your cash flow remains steady.

Shoulder Season Scheduling: You can strategically schedule your maintenance "tune-ups" during April and October. This keeps your technicians busy during slow months and frees them up for high-margin emergency calls when the weather breaks.

The 7 Essential KPIs every HVAC Owner Should be Tracking

As you transition from technician-owner to CEO, you must manage by the numbers rather than by "gut feeling". These seven metrics represent the "vital signs" of a healthy, enterprise-level HVAC operation:

KPI

2026 Benchmark

The Bookkeeper's Perspective

Gross Profit Margin

50-65%

Crucial: If GPM is low, your pricing is wrong or your costs are too high. This is the first number we fix.

Net Profit Margin

>10-15%

Are you actually creating wealth or is overhead eating all of your Gross Profit?

Technician Efficiency

80-85%

We track billable hours vs. paid hours. If this is low, you have a "scheduling leak" that's draining your payroll.

Accounts Receivable Days

< 10 Days Ideally

Minimal balances over 30 days

We monitor how fast cash moves from the field to your bank. As you scale, the longer you provide free loans to customers, the more of a cash crunch your business will feel.

Overhead as a Percentage of Revenue

< 25-35% of Revenue

If this percentage creeps up without a corresponding rise in revenue, the business is becoming top-heavy or inefficient.

Maintenance Agreement Penetration

70-80% Renewal Rate

Continuing to build a steady foundation of business and predictable revenue bolsters shoulder seasons.

Customer Acquisition Cost (CAC)

< $150

Ensure marketing spend is yielding an appropriate ROI and that revenue is growing with marketing spend. If they diverge, then the sales or marketing process needs refinement.

The Golden Rule of KPIs: Data Freshness

A KPI is only useful if it is current. If your bookkeeping is three weeks behind, you are looking at a "rearview mirror" rather than a GPS. In a large fleet, a 5% drop in efficiency can cost thousands of dollars in a single week. Professional HVAC bookkeeping ensures these numbers are updated in near real-time, allowing you to make course corrections before a minor leak becomes a flood.

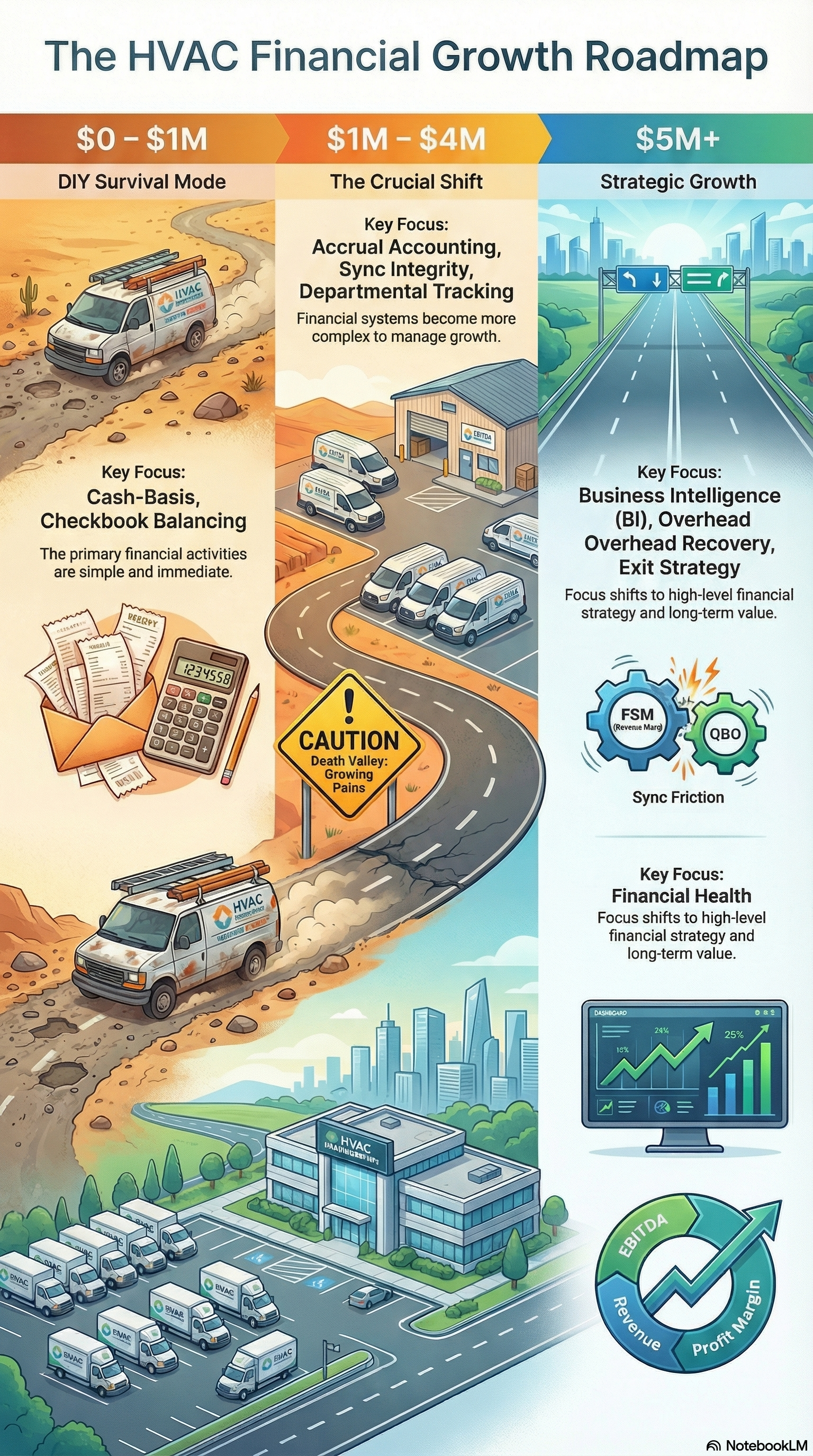

Scaling Your Professional Oversight: The 2026 Roadmap

Scaling a fleet is as much about administrative infrastructure as it is about adding trucks. As your revenue grows, the "who" behind your numbers must evolve to match the complexity of your operations.

Phase 1: The Foundation ($0 – $1M)

The Oversight: Usually the Owner or a multi-tasking Office Manager.

The Workflow: Bookkeeping is often "retrospective," focusing on bank reconciliations and paying bills.

The Risk: Data is often siloed. If the owner is busy in the field, invoices get delayed, and "financial amnesia" sets in regarding unrecorded field expenses.

Phase 2: The Transition & "Death Valley" ($1M – $4M)

This is where most HVAC companies plateau or fail. The complexity of managing 5–8 trucks outstrips the capacity of a generalist.

The Oversight: Partnering with a fractional HVAC-specific bookkeeping firm (like Acc4t).

The Workflow: Shifting to Accrual Accounting and automated FSM-to-QuickBooks syncing.

The Value: You stop just "tracking expenses" and start practicing Overhead Recovery. At this stage, specialized oversight pays for itself by identifying the 5%–10% of profit currently leaking through unapplied labor and improper job costing.

Phase 3: The Enterprise ($5M+)

The Oversight: A hybrid model. You likely have an in-house Administrative Assistant for daily tasks, supported by a specialized firm for high-level Business Intelligence (BI), bookkeeping, and tax strategy.

The Workflow: Advanced KPI monitoring, multi-year tax planning, and preparing the books for a high-value exit or private equity acquisition.

The Goal: Total financial transparency. You can tell exactly which service lines, technicians, and marketing channels are driving your EBITDA.

Frequently Asked Questions

What is the best accounting software for HVAC companies?

QuickBooks Online (QBO) is the undisputed industry standard for 2026. While Xero and Sage are capable, QBO has the most robust API integrations with the leading Field Service Management (FSM) tools like ServiceTitan, Jobber, and Housecall Pro. Using QBO ensures your "Financial Hub" can actually talk to your "Operational Spokes."

How do I set up a trade-specific Chart of Accounts (COA)?

Instead of dozens of accounts, use a clean structure (4000s for Revenue, 5000s for COGS) and utilize Classes in QuickBooks to distinguish between Service, Install, and Maintenance.

Make it easy on yourself: Download our Free HVAC-Specific Chart of Accounts here.

Can I manage my HVAC bookkeeping using only spreadsheets?

Only if you intend to stay a solo operator and even then QBO would make your life easier. Spreadsheets are "dumb" data; they don't sync with your bank, they don't track labor burden automatically, and they are prone to human error. Once you have more than two trucks, the time spent managing spreadsheets is more expensive than hiring a professional.

What is a healthy net profit margin for a residential HVAC company?

The industry average is around 12%, but top-tier businesses are operating at peak efficiency targets of 15% to 22%. If you are below 10%, you likely have a leak in unapplied labor or improper overhead recovery.

How do I calculate "Labor Burden" for my technicians?

Raw wages are just the beginning. To find your Fully Burdened Rate, you must add:

Taxes: FICA, SUTA, FUTA.

Insurance: Workers' Comp (High-premium for trades), Health, Liability.

Benefits: 401k, PTO accruals.

A tech paid $30/hr usually costs the company $52/hr+.

Your billable rate should also include your overhead like rent, vehicles, and insurance.

How do HVAC companies manage cash flow during the "shoulder season"?

The most effective strategy is building Monthly Recurring Revenue (MRR) through maintenance agreements. These automated payments provide a "cash floor" during the mild months. Additionally, we recommend scheduling all non-emergency maintenance tune-ups during the spring and fall to keep your techs billable during these slowdowns.

How often should I review my financial statements?

At a minimum, once a month. However, for a 10+ truck fleet, we recommend a weekly KPI pulse check on Technician Efficiency and Accounts Receivable. If you wait until the end of the quarter to see you're losing money, it’s often too late to fix the cause.

How do I handle unpaid invoices and slow-paying customers?

Implement "Payment in the Field" as a standard. Use your FSM (like ServiceTitan) to collect credit card or financing payments before the tech leaves the driveway. For commercial work, maintain a strict 10-day DSO (Days Sales Outstanding) follow-up process.

When should an HVAC company hire a professional bookkeeper?

The tipping point is usually when your time is better spent making money for the business rather than spending it on admin tasks that you can offload. At two to three trucks, the complexity of expense, payroll, and job costing becomes a distraction from your primary role: growing the business.

And hiring an office manager than can effectively run dispatch, answer telephones, manage customers, fill out warranty paperwork, and manage the bookkeeping would be a unicorn of talent. Keep them forever!

Are HVAC vehicle and fuel expenses fully tax-deductible?

Yes, but how you deduct them matters. For 2026, most fleets benefit from Section 179 deductions for new vehicle purchases and "Actual Expense" tracking for fuel and maintenance. Your bookkeeper should ensure every truck is its own asset category for precise depreciation tracking.

What is the most common financial error in a 10-truck HVAC business?

Failing to reconcile Undeposited Funds and "Clearing Accounts." If your FSM says you collected $50,000 but your bank only shows $48,000, that $2k gap is often lost in "sync errors." If you don't reconcile this, you will pay taxes on money you never actually received.

Should I use flat-rate or T&M pricing? Flat-rate pricing is superior.

It eliminates "customer clock-watching" and allows you to bake your labor burden and overhead into every task. It rewards your fastest, most skilled technicians without penalizing your profit margins.

Final Thought: Your Books are Your GPS

Managing a multi-truck fleet without specialized bookkeeping is like trying to navigate a blizzard with a broken thermostat. You might feel the heat, but you have no idea if the system is actually working.

Is your business set for 20% profit in 2026? Schedule a 2026 Financial Leak Detection with Acc4t today.

90-Day Moneyback Guarantee

We stand by our work—no excuses, no fine print. If you're not 100% satisfied within the first 90 days, we'll refund up to 50% of one-time investments or 100% of recurring service fees. Your success is our priority, and we’re confident in delivering results that matter.

Copyright 2026

All Rights Reserved

https://storage.googleapis.com/msgsndr/p98iMZ6oQEd0B8FNCsvk/media/678a7c4da120156f79a7e704.jpeg

https://storage.googleapis.com/msgsndr/p98iMZ6oQEd0B8FNCsvk/media/67763277b0a11f9c9fbd213c.jpeg